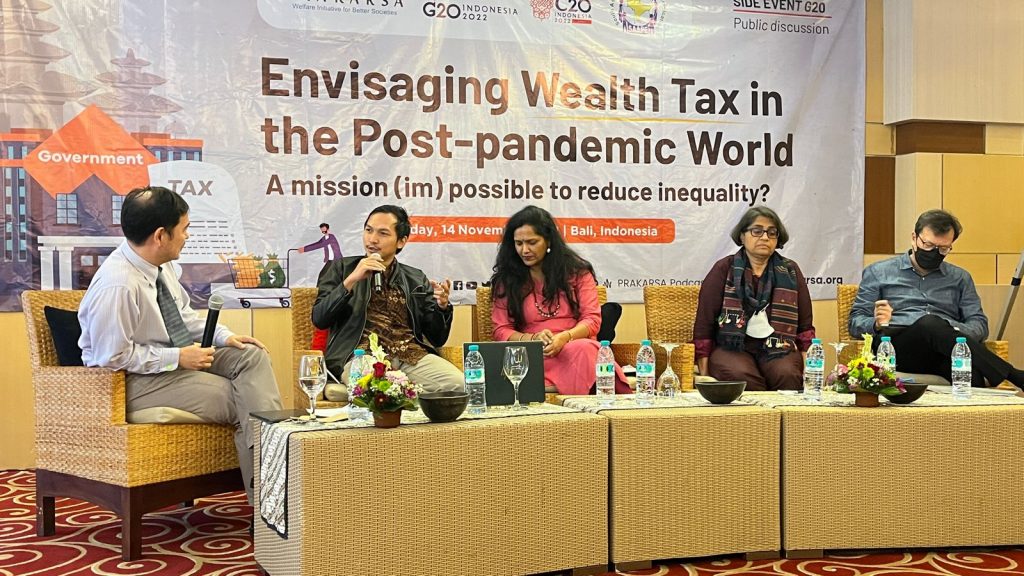

The PRAKARSA, Bali - The PRAKARSA in collaboration with C20 Indonesia and the South Asian Alliance for Poverty Radication held a G20 side event entitled “Envisaging Wealth Tax in the Post-pandemic World” to discuss whether wealth tax could be an alternative to fiscal policy to increase state revenues. The event highlighted the current need for wealth taxes and how this instrument can pave the way for more just and equal social conditions through panel discussions and the release of two research reports. On Monday (14/11/2022).

The event began with remarks by Herni Ramdlaningrum – C-20 Co-Chair and Program Manager PRAKARSA, who argues that imposing taxes on the super-rich can not only help reduce general inequality, but also reduce gender inequality through using income to create a care economy—moving unpaid care work away from women by giving them economic status, access to jobs, and generate income.

Following the remarks, two reports on “Wealth tax discourse in Southeast Asia and South Asia: Prospects and challenges” were launched. Researchers from SAAPE and PRAKARSA presented the findings.

While sharing the findings from the study, Irvan Tengku Harja, researcher from PRAKARSA, stated, “there needs to be another dimension for poverty alleviation, such as wealth tax as part of the wealth redistribution instrument. Later, wealth tax revenues can be explicitly allocated to social development programs such as taxes on food, education, health, humanitarian assistance, etc.”

According to Forbes, during the Covid-19 pandemic, the average wealth of the hundred richest people in Indonesia has increased, while the majority of people are facing economic difficulties. Irvan added, "we surveyed members of the DPR, and among the 61 MPs who filled out the survey, 77 percent of them agreed to support a wealth tax because it is necessary for post-pandemic economic recovery."

Based on her points, Samira Hanim from PRAKARSA highlighted that historically, Islam recognized a wealth tax since the early years of Islam. The crop failure conditions resulted in an increase in the number of poor people, urging Islamic leaders to impose additional zakat for the rich.

In the context of South Asia, “Disposable income inequality has the potential to reduce economic growth. Wealth taxes are not just about increasing state revenues. It can also reduce wealth inequality, is very progressive, stimulates economic activity, and has broad public support,” said Sudhir from SAAPE.

Adding to Sudhir's findings, Jyotsna shared that a wealth tax can improve inequality as well as solve the problem of economic growth.

Fair taxation of equal socio-economic conditions cannot be achieved without keeping women at the center of this discussion, as they share an important part of the economy. Explaining the issue, TAFJA member Vidya Dinker from INSAF stated, “the pandemic is exacerbating existing gender inequality, but the government is even more standing with the rich, especially when it comes to taxation. The government doesn't care how to increase income to pay for women who work in families, factories, or farms. There are no women's economic rights in the tax system.”

Tony Salvador of the Third World Network also clarifies a common misconception that a wealth tax is a double tax. He mentioned that “we are now experiencing asymmetry and unfair tax schemes between the poor and the super rich. Even if the super-rich don't sell their assets, they can still be subject to this wealth tax for owning the assets. That's the idea of a wealth tax. This will apply to net worth only and the ideal design has no double tax issues. A wealth tax will only work politically if you are subject to certain goals such as taxes on food, hospitals, vaccines and other expenses on health.”

The launch was followed by a panel discussion and question and answer session on the subject of wealth tax and how to realize this mission in a post-pandemic world. How to deal with issues of politics and public trust as well as taking concrete actions to make this wealth tax issue included in the discussion at the G20 forum was also a concern of the participants. “Not only is this an oral request, but we are also making the property tax in our written communique a top three recommendation. It will have to be a long struggle to advocate and campaign for this issue in the next G20 chairmanship and beyond," said Vidya in a firm statement.

The discussion was closed with a statement by the moderator, Jacques-Chai Chomthongdi (Private Sector Engagement Lead – Asia, Oxfam International), who stressed that we must continue to push and experiment to achieve pro-poor and vulnerable people around the world in the future.